Enate for banking

Unlock operational excellence in banking

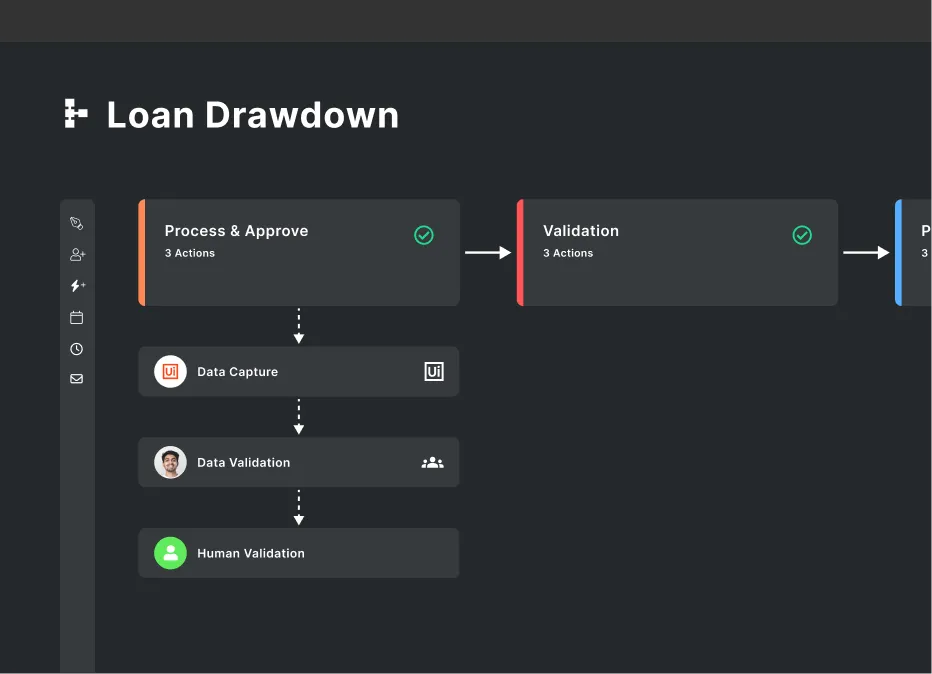

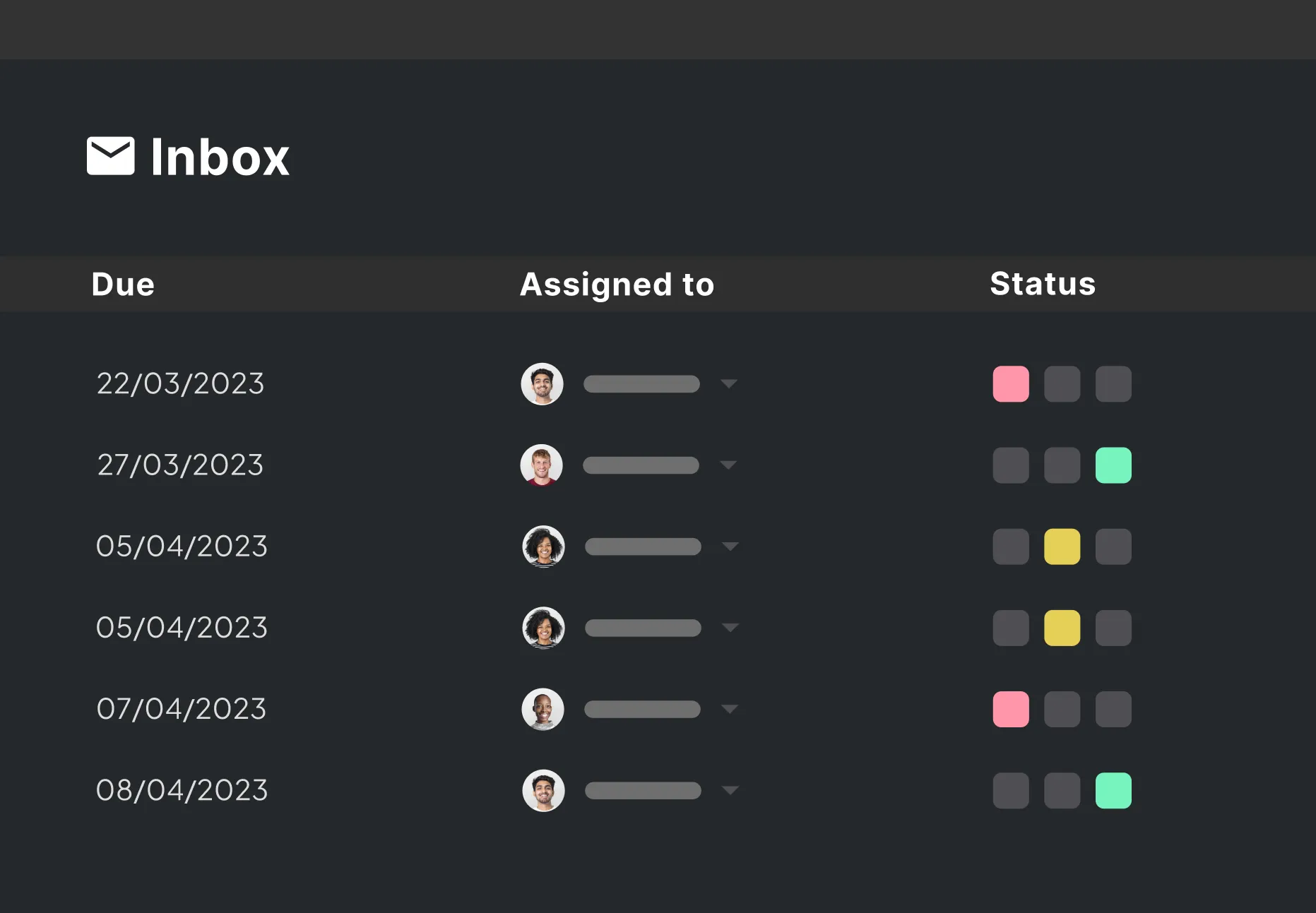

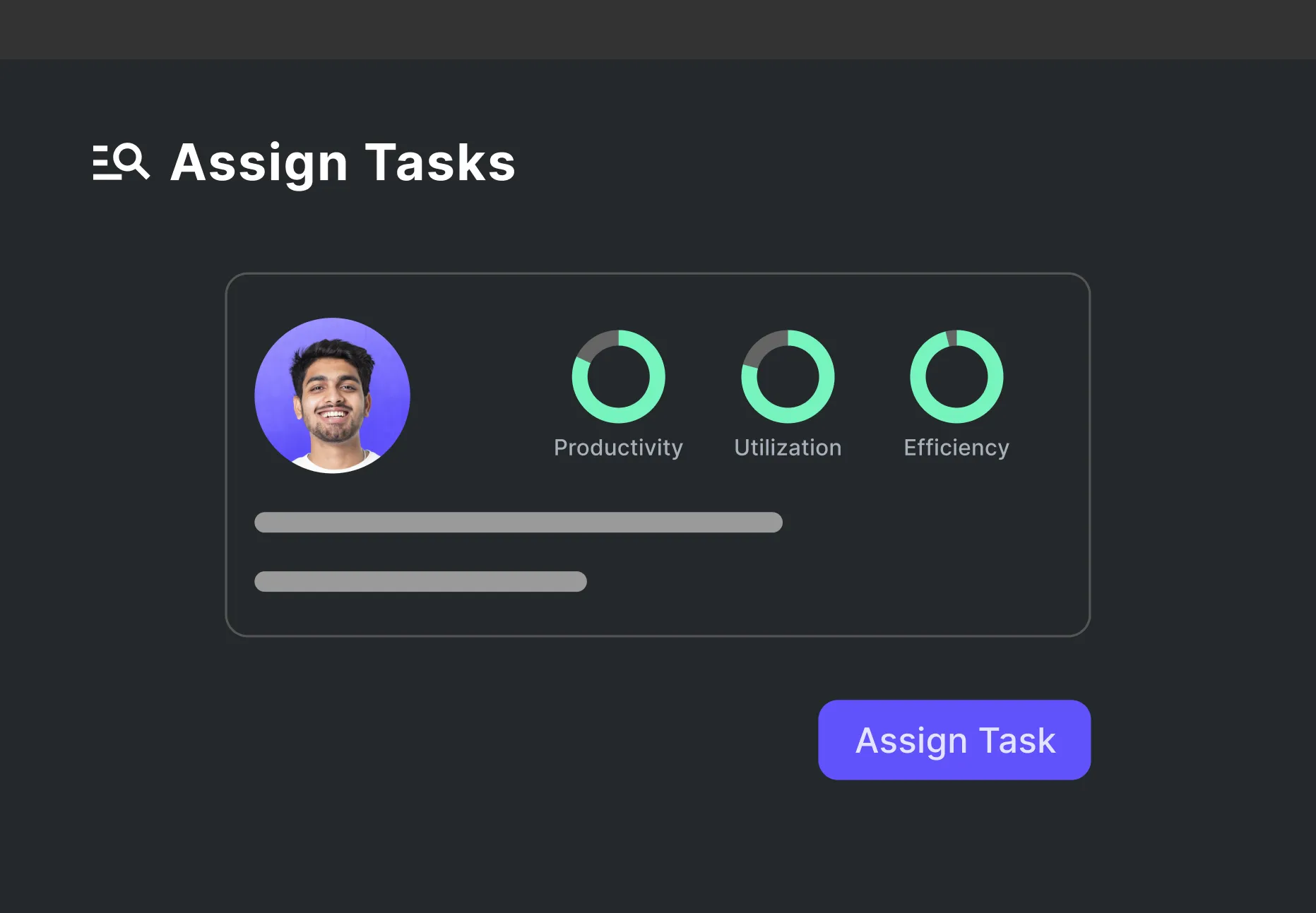

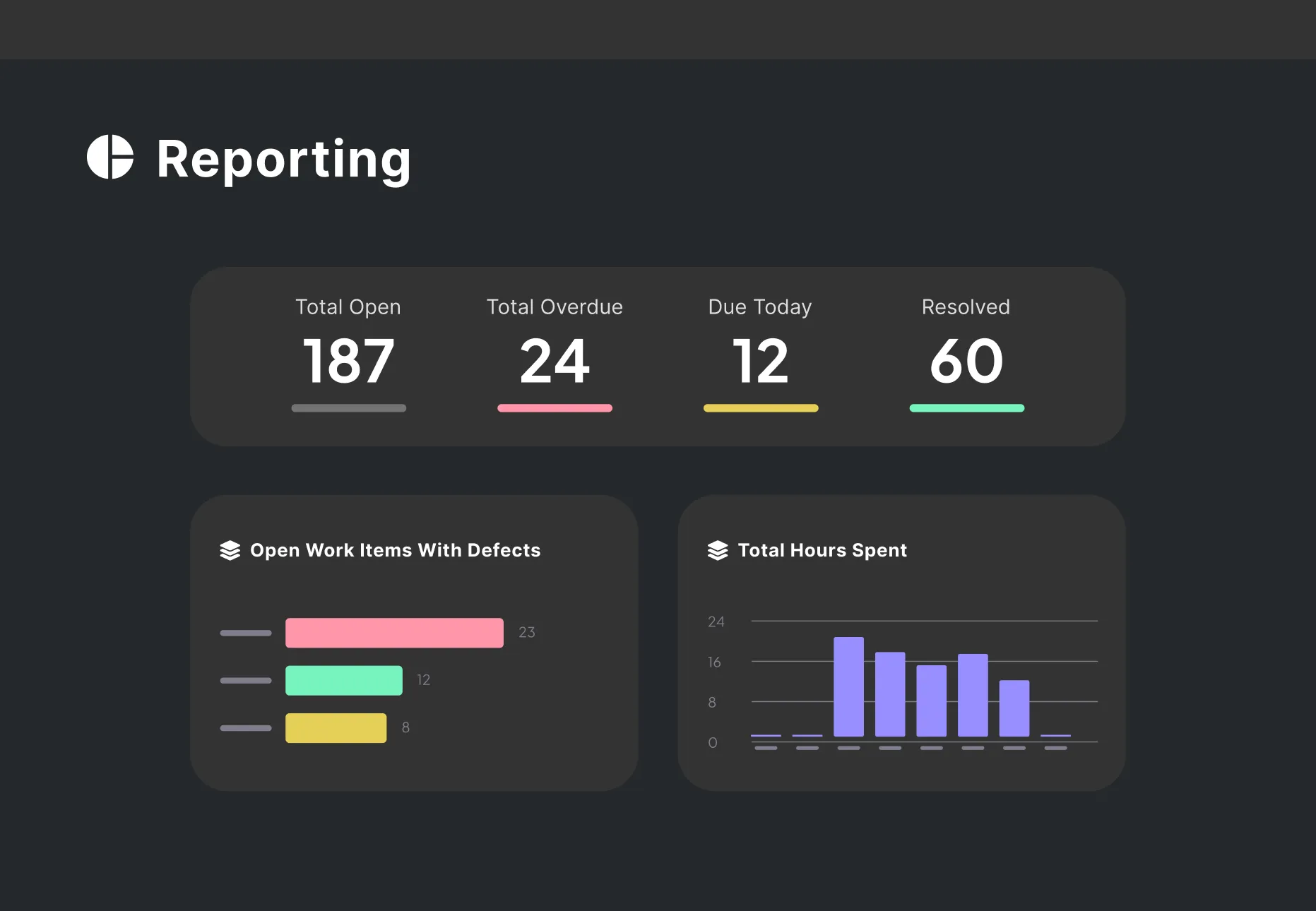

Use Enate’s end-to-end orchestration platform to organize, manage and streamline banking processes.

All your banking operations under one roof

Enate sits on top of your operations, providing end-to-end insights on speed, efficiency and bottlenecks so you can mitigate risks, solve problems and identify opportunities in real-time.

Banking use cases

Enate’s orchestration solution will help you run, manage and streamline the following banking processes:

KYC & AML screening and monitoring

Merchant maintenance

Fraud chargeback services

Banking transactions/cases

Merchant onboarding

Fraud and dispute chargeback

Mortgage

Merchant due diligence

Fraud alert management